Finding the best car insurance for young drivers can be challenging. They often face higher premiums due to limited driving experience.

Young drivers need affordable yet comprehensive insurance. With so many options, it’s hard to know where to start. Affordable coverage is crucial for young drivers who are often on a tight budget. Safety, benefits, and customer service are important factors too.

In this guide, we’ll explore the top car insurance options for young drivers. Our goal is to help you find coverage that balances cost with quality. Stay tuned to learn more about the best choices and make an informed decision.

Credit: www.valuepenguin.com

Introduction To Car Insurance For Young Drivers

Young drivers face many challenges. They often pay higher insurance rates. This happens because they lack driving experience. Accidents are more common among new drivers.

Insurers see young drivers as high-risk. This leads to expensive premiums. Finding the best car insurance can be tough.

Challenges Faced By Young Drivers

Young drivers have to deal with high costs. These include maintenance and fuel. Adding insurance makes it harder.

Many young drivers are students. They have limited budgets. High premiums can be a burden.

Lack of experience is another issue. It leads to more mistakes on the road.

Importance Of Car Insurance

Car insurance is important. It protects from financial loss. Accidents can happen anytime. Repairing cars can be very costly.

Insurance also covers medical expenses. This is crucial after accidents. It provides peace of mind. Knowing you are protected is comforting.

Factors Influencing Insurance Rates

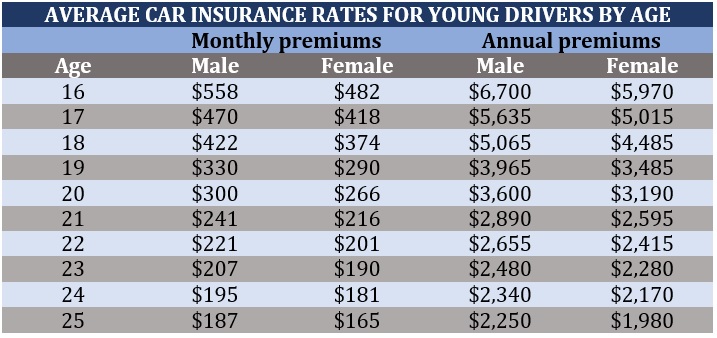

Young drivers often face higher car insurance rates due to inexperience. Safe driving records and good grades can help lower costs. Comparing quotes from different insurers is essential to find the best rates.

Age And Experience

Young drivers often pay more for car insurance. This is due to their age and lack of experience. Insurance companies see them as high-risk drivers. They have less practice behind the wheel. This makes them more likely to have accidents. As they gain more experience, their rates might go down.

Type Of Vehicle

The type of car also affects insurance rates. Sports cars and luxury vehicles cost more to insure. These cars are faster and more expensive to repair. On the other hand, a small and safe car may have lower rates. Insurance companies like cars with good safety features.

Driving Record

A clean driving record can help lower insurance costs. Tickets and accidents raise rates. Insurance companies look at your history. Fewer incidents mean lower risk. Safe driving habits can save money on insurance.

Affordable Car Insurance Options

Discover affordable car insurance tailored for young drivers. These options offer coverage that balances cost and protection. Perfect for those just starting their driving journey.

Usage-based Insurance

Usage-based insurance can be a good choice for young drivers. This type of insurance tracks how you drive. It uses devices or apps to monitor your driving habits. If you drive safely, you can get lower rates. This is because the insurance company sees you as less risky. You pay for how much you drive and how well you drive. It can be a cost-effective way to get coverage.

Good Student Discounts

Good student discounts can help young drivers save money. Many insurance companies offer discounts for students with good grades. If you have a B average or better, you may qualify. This can lower your insurance costs. Keeping good grades can be a smart way to save on car insurance. It shows you are responsible, both in school and on the road.

Credit: www.valuepenguin.com

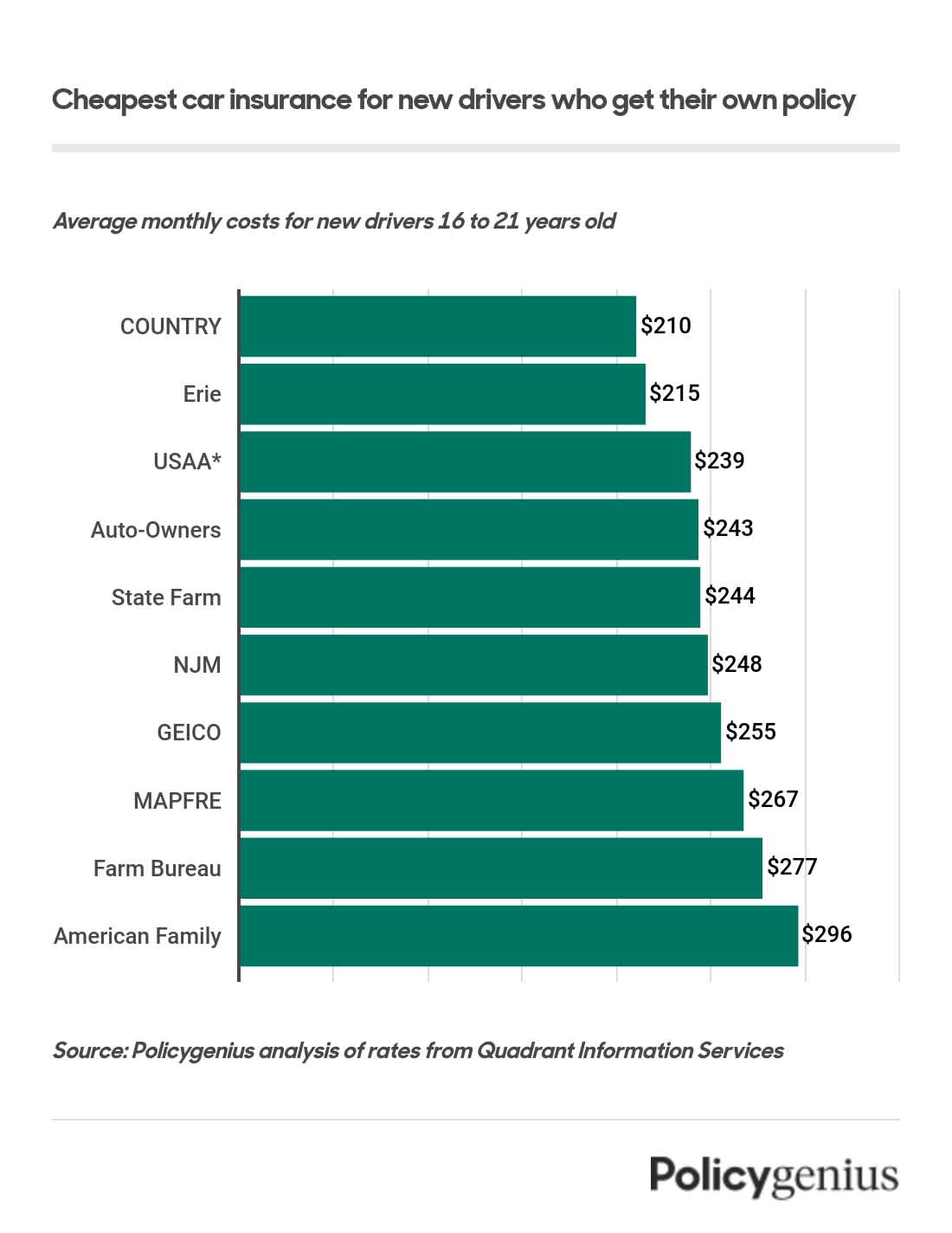

Reliable Insurance Providers

Finding the best car insurance is hard. Especially for young drivers. Some companies are more trusted. They offer good rates and help fast. These companies get high ratings from many customers. They are known for their great service.

Good customer service is key. When you need help, they should respond fast. Claims should be easy to file. You want your car fixed fast. Some companies have apps. You can file claims using your phone. This makes it easy for young drivers.

Tips To Lower Insurance Costs

Completing a safe driving course can help reduce your insurance costs. Insurance companies reward young drivers who take these courses. They see them as less risky. These courses teach important skills. They make you a better driver. And a safer driver. Some courses are even available online. Easy to access and complete. Always check with your insurer first. Make sure they recognize the course.

Bundling policies is another way to save money. You can combine car insurance with other types. Like home or renter’s insurance. This often gets you a discount. Insurance companies like when you use more of their services. It shows loyalty. And they reward that. Always ask your insurer about bundling options. It can make a big difference. Easy and effective.

Understanding Coverage Types

Liability coverage helps if you cause an accident. It covers the other person’s injuries and property damage. This type of insurance is required in most states. It does not cover your own car or injuries. Always check your state’s minimum coverage levels.

Comprehensive and collision coverage are important for young drivers. Comprehensive covers non-collision events like theft or weather damage. Collision covers damage from hitting another car or object. Both types help to protect your investment in your car. They usually come with deductibles. Make sure to choose an affordable deductible.

Choosing The Right Policy

Young drivers need special insurance. Many options exist. Think about what you need. Do you drive often? Do you have a new car? These questions help you decide. Budget matters too. How much can you pay each month? Look at your income. Look at your expenses. Find a balance. You need the best coverage for the best price.

Get quotes from many places. Different companies, different prices. Compare them. Look for discounts. Some companies give discounts for good grades. Others for safe driving. Make a list. Write down the details. Check for extra benefits. Roadside assistance, rental car coverage. These can be very helpful. Choose the best deal that fits your needs.

Credit: www.policygenius.com

Frequently Asked Questions

What Is The Best Car Insurance For Young Drivers?

The best car insurance for young drivers offers affordable rates, comprehensive coverage, and discounts for good grades and safe driving.

How Can Young Drivers Get Cheaper Car Insurance?

Young drivers can get cheaper car insurance by maintaining a clean driving record, taking defensive driving courses, and qualifying for discounts.

Why Is Car Insurance More Expensive For Young Drivers?

Car insurance is more expensive for young drivers due to their lack of experience and higher risk of accidents.

What Discounts Are Available For Young Drivers?

Discounts for young drivers include good student discounts, safe driver discounts, and discounts for taking driver education courses.

Conclusion

Choosing the best car insurance for young drivers takes careful consideration. It’s essential to compare different policies. Look for affordable premiums and good coverage. Discounts can make a big difference. Always read the fine print. Understanding the terms helps avoid surprises.

A reliable insurer provides peace of mind. Safe driving habits can lower costs over time. Start with research and make informed decisions. Protecting young drivers on the road is crucial. Happy driving!